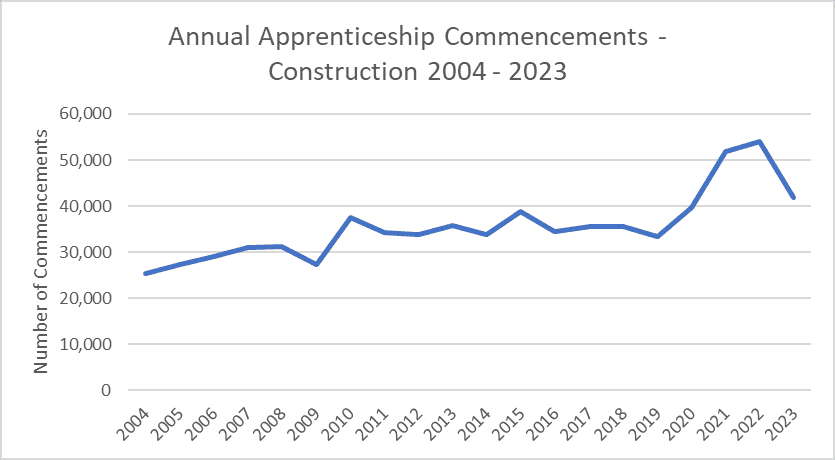

Analysis undertaken by BuildSkills Australia has found that over the past 20 years the number of apprentices in the construction industry has increased by 65.8%, from 25,295 apprentices commencing in 2004 to 41,934 apprentices commencing in 2023. The most recent year end figure (41,934 apprentices commencing in 2023) is the third highest number of commencements in a single year in the 20 years from 2004.

While there were fewer individuals beginning apprenticeships in 2023 as compared with 2022, this belies the positive longer-term trend. Indeed the 2022 figure of 54,035 apprenticeships commencing is the highest number of annual commencements in the last 20 years.

Figure 1

Apprenticeship Commencements in Construction 2004 - 2023

Data: 2024 National Centre for Vocational Education Research

The steep increase starting in 2020 and lasting to 2022 was driven by the Boosting Apprenticeship Commencements and the Completing Apprenticeship Commencements programs, which were time-limited COVID-19 economic response measures introduced to support businesses to take on apprentices. The trend from 2004 through 2019 shows a 32.3% increase in apprenticeship commencements in the construction industry. In this context the drop from 2022-2023 coincided with the end of the COVID-19 incentives.

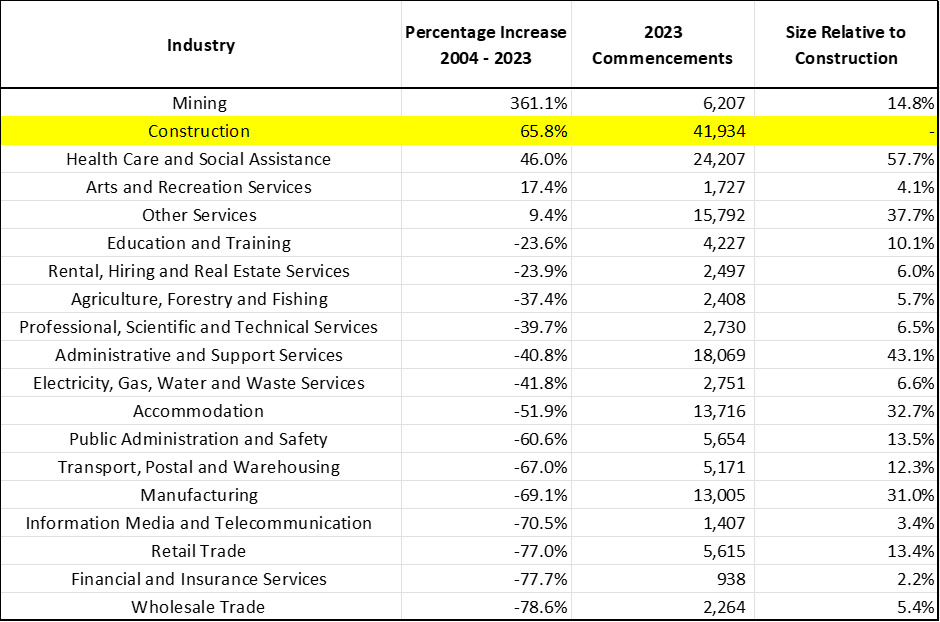

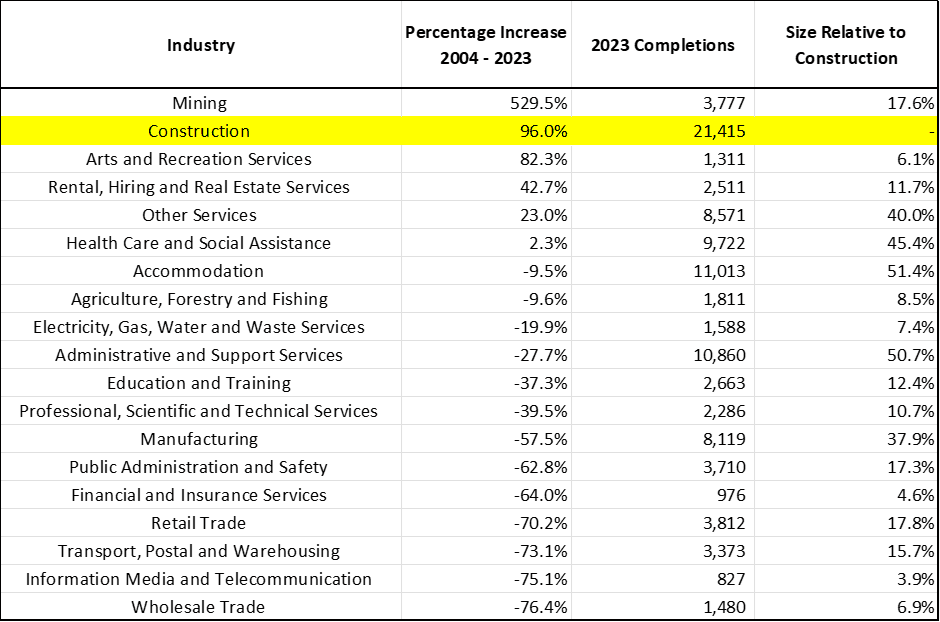

A comparison of apprenticeship commencements from 2004 – 2023 across industry shows that construction has the second largest percentage increase over that 20-year period, bested only by the mining industry. Moreover only 5 industries of the 19 defined by the National Centre for Vocational Education Research (NCVER) showed positive trends in apprenticeship commencements. It is worth noting here that construction is by far the largest industry for apprenticeship commencements. The next largest cohort, Health Care and Social Assistance, has a cohort that is only 57.7% the size of the construction industry cohort.

Table 1

Apprenticeship Commencements all Industries 2004 - 2023

Data: 2024 National Centre for Vocational Education Research

While there has been a decline in the 12 months ending in 2023 by comparison to 2022 this has to be viewed in context of the COVID-19 apprentice incentives that saw a record increase in apprenticeship commencements. This is expected to translate to an increase in the overall number of apprentices completing. It is worth noting that construction apprenticeship indicators were trending broadly upward for the two decades prior to the pandemic.

Demand for construction in the economy has had to keep pace with a growing population and changing consumer preferences and will only increase over time. However, we should interpret single year declines cautiously. The data doesn’t point to a crisis that portends a major labour supply shortage based on historical demand. Over the long term and by comparison with other industries the construction industry has one of the healthiest pipelines of apprentices in the whole economy.

Promoting the rewarding aspects of built environment careers is an important priority. This includes elements that are sometimes underrated such as scope for entrepreneurialism, job security and the breadth of long-term opportunities. The varied and rewarding pathways within the industry should be supported and championed in order to sustain a robust supply of labour into this crucial part of the Australian economy.

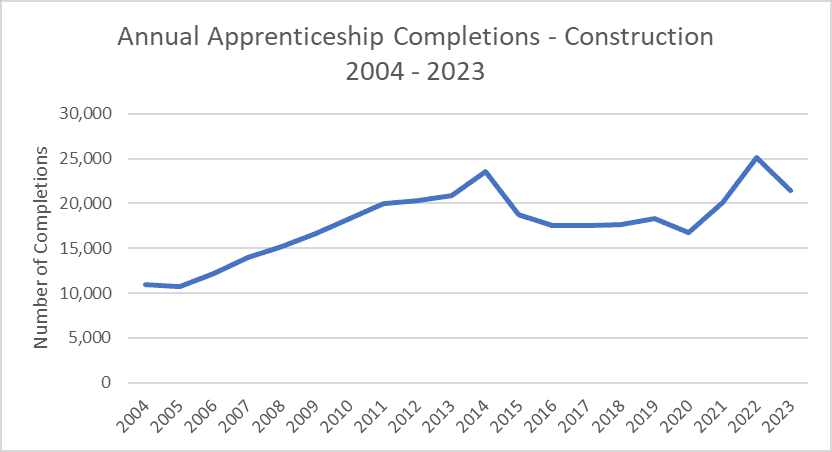

It’s important to view commencements in the context of actual completions. Commencement speaks in part to attraction to the industry and the data indicates attraction to construction apprenticeships is strong and has been strong over 20 years.

Completion speaks more to how many employees are likely matriculating into the industry. Below shows the 20-year trend of completions. From 2004 to 2014 completions went up by 115.5%. However, the year 2015 – 2020 saw a decline in completions of 10.3%. The introduction of the COVID-19 incentives saw completions spike to a 20-year high before it came back down in 2023.

Figure 2

Apprenticeship Completions in Construction 2004 - 2023

Data: 2024 National Centre for Vocational Education Research

From 2004 to 2023 the average number of annual apprentice completions in construction has been 75.5 per 100,000 population. In 2023 that figure was 79.4 apprentices per 100,000. This suggests that the rate of new apprentices potentially going into the construction industry is above the 20-year average which is important in the context of Australia’s growing demand for built environment services.

When we consider the ambitions of programs such as the National Housing Accord, Future Made in Australia and the built environment demand related to our push toward net zero, not to mention the growing demand of an expanding population, it is critical to stay focussed on maintaining an appropriate supply of new construction workers relative to the total population.

For context the construction industry still has the second highest rate of growth in terms of apprenticeship completions. Again, only bested by the mining industry and still generating that growth from a significantly larger base of completions.

Table 2

Apprenticeship Completions all Industries 2004 - 2023

Data: 2024 National Centre for Vocational Education Research

Ultimately, while the growth of the pipeline of workers into the construction industry remains positive the question remains, how much support is required to ensure that pipeline is strong enough to meet expected future demand in the years and decades ahead?

Construction is by far the largest industry in terms of apprentice attraction and completion. The level of growth in these areas given the size of the industry, relative to other industries, is impressive to say the least. However, given the community’s ever-growing appetite for the built environment, can we continue ‘business as usual’ or is further intervention required?

Photo credit: Hutchinsons Builders